A demand loan is a type of loan that the lender can ask to be repaid at any time. Unlike fixed-term loans, there’s no set repayment schedule or maturity date. This means the borrower must be ready to repay the full amount whenever the lender demands it.

Understanding demand loans is important if you’re considering borrowing money in Canada. They offer flexibility but also carry risks. Let’s break down what demand loans are, how they work, and what you should watch out for.

What Exactly Is a Demand Loan?

A demand loan is a loan without a fixed repayment term. The lender can request repayment at any moment. This type of loan is often used between businesses, individuals, or financial institutions.

Because there’s no fixed schedule, demand loans are flexible for both parties. The borrower can use the funds without worrying about monthly payments, but the lender holds the power to call the loan due at any time.

How Demand Loans Differ from Other Loans

Most loans have a fixed term-say, five years for a mortgage or three years for a car loan. You repay the loan in regular instalments over that period. Demand loans don’t work like that. They are open-ended until the lender asks for repayment.

This flexibility can be useful in certain situations but can also create uncertainty for borrowers.

Who Uses Demand Loans in Canada?

Demand loans are common in several scenarios:

- Between family members or friends: Informal loans where repayment terms are flexible.

- Business transactions: Companies may use demand loans to cover short-term cash flow needs.

- Banks and financial institutions: Sometimes offer demand loans to clients with strong credit history.

- Real estate: Occasionally used for bridge financing or short-term property deals.

If you’re a Canadian business owner or individual needing quick access to funds, a demand loan might come up as an option.

How Does a Demand Loan Work?

When a lender offers a demand loan, they provide funds without a fixed repayment date. The borrower can use the money as needed. The lender can then ask for repayment whenever they want.

Interest may be charged daily or monthly. The borrower must pay interest until the loan is fully repaid. Since the lender can call the loan anytime, the borrower should keep funds available to repay quickly.

Example

Imagine a small business owner in Toronto who needs $50,000 to cover payroll temporarily. They get a demand loan from a local lender. The lender charges interest monthly but can ask for the loan back at any time. The business owner uses the funds but keeps cash ready to repay if asked.

Advantages of Demand Loans

Demand loans offer benefits that can suit specific needs:

- Flexibility: No fixed repayment schedule means you can manage cash flow more freely.

- Speed: Often quicker to arrange than traditional loans.

- Lower costs: Sometimes fewer fees than long-term loans.

- Short-term solution: Useful for bridging temporary financial gaps.

For Canadian borrowers who need quick, flexible funding, demand loans can fill a gap traditional loans don’t cover.

Risks and Downsides of Demand Loans

Demand loans come with risks you need to understand:

- Repayment uncertainty: The lender can demand repayment anytime, which can strain your finances.

- Higher interest rates: Because of the risk, interest rates may be higher than fixed loans.

- Potential for default: If you can’t repay on demand, you risk legal action or damage to your credit.

- Lack of protection: Unlike fixed-term loans, demand loans offer less security for borrowers.

If you’re considering a demand loan, prepare for the possibility of sudden repayment requests.

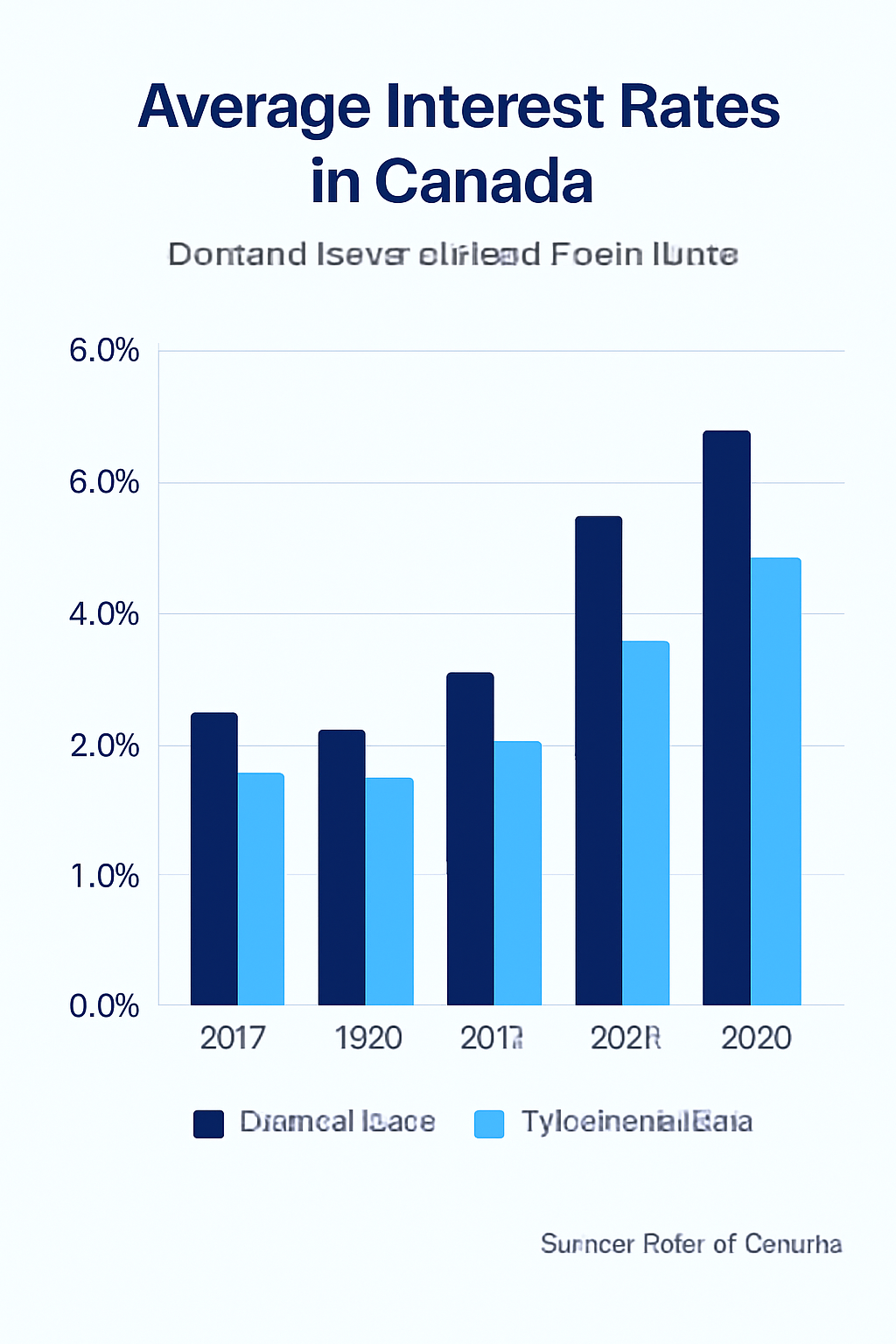

Demand Loan Interest Rates in Canada

Interest rates on demand loans vary widely. They depend on factors like:

- The borrower’s creditworthiness

- The lender’s policies

- Loan amount and purpose

Rates can be higher than conventional loans because lenders face more risk. For example, a demand loan might carry an interest rate of 6% to 12% annually, compared to a mortgage rate around 3-5%.

How to Get a Demand Loan in Canada

Getting a demand loan usually involves:

- Finding a lender: This could be a bank, credit union, private lender, or even a family member.

- Negotiating terms: Interest rate, repayment terms, and any collateral.

- Signing an agreement: Even informal loans should have written terms to avoid disputes.

- Receiving funds: Once agreed, the lender provides the money.

- Repaying on demand: Be ready to repay when asked.

Because demand loans can be informal, it’s wise to document everything clearly.

When Should You Consider a Demand Loan?

Demand loans suit situations where you need:

- Short-term cash flow support

- Flexible repayment options

- Quick access to funds without lengthy approval processes

For example, a Canadian entrepreneur waiting on client payments might use a demand loan to cover expenses temporarily.

What Should You Watch Out For?

Before accepting a demand loan, consider:

- Can you repay immediately if asked?

- Are the interest rates reasonable?

- Is the lender trustworthy?

- Have you documented the loan terms?

Failing to plan for sudden repayment can lead to financial trouble.

Alternatives to Demand Loans

If a demand loan feels too risky, consider:

- Line of credit: Offers flexible borrowing with set limits and scheduled repayments.

- Personal loan: Fixed terms and predictable payments.

- Credit cards: For smaller amounts, though interest rates can be high.

- Government programs: Some Canadian programs offer financial support for businesses.

Each option has pros and cons depending on your needs.

Final Thoughts on Demand Loans

Demand loans offer flexibility and speed but require careful planning. They’re useful for short-term needs but can create repayment pressure. Always understand the terms and risks before borrowing.